Los Angeles Chapter 7 Bankruptcy Lawyer

California Debt Settlement Attorney

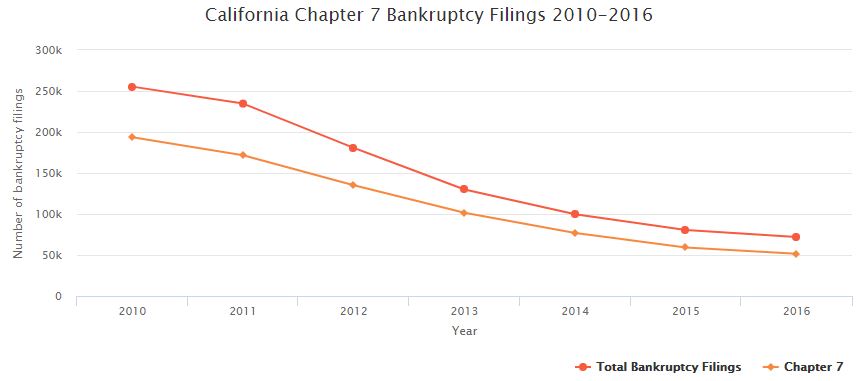

Chapter 7 or straight (liquidation) bankruptcy, is the most common type of bankruptcy in the U.S. This type of bankruptcy is a good option when you have too much debt or have too many creditors for debt settlement. Additionally, some of your assets can be protected (these are known as exempt assets). In a Chapter 7 bankruptcy, a trustee is given authority to examine all financial records in order to review the bankruptcy petition. It is the trustee’s job to verify that the information provided to the court matches your financial documents, such as pay stubs and bank statements, and ensure they are accurate. Although Chapter 7 bankruptcies have declined in California over the years, it should not discourage you from reaching out and exploring your options.

As long as you haven’t received a Chapter 7 bankruptcy discharge in the past eight years and depending on your income and the nature of your debts, you should be able to file. While the process can take four to six months, Chapter 7 bankruptcy enables individuals to eliminate credit card debt, judgments, medical bills and other types of debt so they can move forward with their lives without the loss of exempt assets.

Protecting Your Assets In Chapter 7 Bankruptcy

Once it becomes clear that a bankruptcy filing should take place, the question of the best time to file arises. Our Chapter 7 bankruptcy lawyers carefully assess the factual and legal issues of your case to ensure the best outcome. Because of this careful approach, except in those rare circumstances where our client knew in advance of this possibility and decided to proceed with the case anyway, we have never had a client lose an asset in a bankruptcy case.

Affordable Fee Plans

Our Chapter 7 bankruptcy lawyers are committed to delivering aggressive and creative debt solutions at affordable fees. We have developed an innovative fee structure that allows us to bundle legal services for a flat or monthly fee. This enables our clients to cap their costs for legal services or plan their monthly expenses for filing chapter 7 bankruptcy.

Since we handle all types of bankruptcy and nonbankruptcy alternatives, our lawyers will assist you in finding the best solution for you, not the one which is best for the firm. For more information, contact Weintraub & Selth, APC, at or toll-free .

“A top-notch establishment! You can tell how invested they are in their work — it shows in how they care about their clients! This law firm provides a combination of compassion and excellent representation. I highly recommend Weintraub & Selth, APC, for your Bankruptcy Law needs.”

– Nancy L.